Although top 500 largest Vietnamese private enterprises (VPE500) represent a small part of the number of local enterprises, they has greatly contributed to the operations of the private economic sector and the national economy, according to insiders.

The information was unveiled at a workshop held in Hanoi on August 10 to release a report on the assessment of the 500 largest Vietnamese private enterprises (VPE 500), with the event featuring the presence of several leading economic experts from various agencies.

The function was co-hosted by the National Centre for Socio-Economic Information and Forecasting (NCIF) and the Konrad Adenauer Foundation (KAS) in Vietnam.

Upon addressing the occasion, Dr. Tran Toan Thang, director of the Department of Industrial Forecast and Enterprise Development under the NCIF, underscored the growing importance of Vietnamese private enterprises (VPEs), especially the VPE 500, in relation to the overall health of the national economy as a whole.

Despite the VPE500 representing only a small part of the number of enterprises, due to its outstanding size and business results it greatly contributes to the operations of the private enterprise sector.

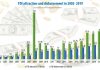

Between 2016 and 2019 the VPE500 only accounted for 0.089% of total enterprises, yet created 10.4% of all jobs, occupied 13.0% of total assets, and generated 15.8% of net revenue.

A separate review conducted on 2019’s VPE500 portfolio in the period from 2016 to 2019 shows that it recorded a faster growth rate in terms of size compared to other business groups. VPE500 firms had an asset growth rate of approximately 15.4% annually compared to just 5.6% in the general private sector. Similarly, VPE500 members’ revenue increased by 11.7%, while that of other businesses’ revenue climbed by 6.6%.

Thang also pointed out several strengths and the impact of the VPE500 on other private businesses, noting that the group not only has a stronger foundation in technology, equipment, and machinery compared to other private enterprises, but the source of these assets also differs. Indeed, a higher percentage of VPE500 members engaging in self-developed machinery activities and seek to utilise advanced technology.

Furthermore, the group has a higher rate of automation and digitalisation compared to the rest. This highlights that large enterprises have been the driving force of the private sector in improving long-term productivity and technology development and application.

The VPE500 also boasts a good relationship with private enterprises in general. The structure of domestic suppliers on raw materials for private enterprise production is typically more geared toward domestic enterprises, while the share of supply from FDI companies is less than that of VPE500 members.

Private enterprises tend to have a narrower scope, focusing primarily on provincial and regional suppliers, while the percentage of VPE500’s enterprises importing input materials stands at nearly four times higher than the former.

With regard to customer relations, although FDI enterprises make up a smaller proportion of the structure of the group’s important clients, the orders are greater than those of private enterprises. In general, the revenue generated by the FDI group for the VPE500 is higher than that of private enterprises, which stands at approximately 4%.

However, experts outlined that the VPE500 has so far not developed into a powerful force as expected, with only a few large private firms having attained world-class stature, despite the fact that private enterprises in the nation have been steadily expanding.

Even with the recent emergence of a small number of large private businesses, the value of Vietnamese brands remains lower than that seen in many other Southeast Asian nations. Meanwhile, small and medium-sized private businesses continue to face numerous challenges during the development process, both objective and subjective.

Think tanks have pointed out that more specific policies are required in order to build a large and stable growing force of private enterprises that can enjoy consistent growth, withstand huge external shocks, and increase the overall efficiency of the economy as a whole.

The policies for enterprises over the coming years must therefore continue to be orientated towards not only creating favourable conditions for enterprises to enter the market, but also surviving and growing. In particular, it can be viewed as necessary to encourage large enterprises to invest in improving productivity and gradually turn to in-depth growth.

This can be seen through the issuance of economic policies to promote business partnerships, encouraging large companies, state-owned enterprises, and FDI businesses to form joint ventures with domestic SMEs, as well as improving the overall capacity of enterprises to participate in global production networks, supply chains, and value chains.

They also emphasised the necessity of encouraging and creating movements so that cities and provinces can develop their own top-tier private enterprises, based on local advantages which reach out to the whole country.

At the workshop, Dao Thu Trang, head of Business Development Services under the German Industry and Commerce Vietnam (AHK Vietnam), briefed participants on an overview of the German business community based in Vietnam, noting that most German investments are located in Ho Chi Minh City.

She analyzed several reasons for this, including economic reforms which took place in the 1980s and 1990s, stronger economic development, perceived higher openness of the local population and business partners, as well as higher GDP per capita, all of which has led many companies to start sales and sourcing operations in the southern city.

Notably, she underlined the significance of a number of bilateral and regional Free Trade Agreements (FTAs) that the country has signed with its partners, especially the EU-Vietnam Free Trade Agreements (EVFTA), while highlighting the nation’s political stability, availability of qualified workforce, and improved business climate.